tax lien nj sales

Guides resources and stories about New York City real estate and COVID-19. Your employer will have withheld New York state taxes.

Free Tax Lien Training Ustaxlienassociation Com

Real property may not be abandoned.

. A federal tax lien exists after. A full schedule of Bid4Assets county tax deed sales foreclosure auctions and government surplus auctions. Universal Title Application replaces the OSSS-7 OSSS-27 OSSS-52 MVC-2 OSSS-85C pdf Attention Vehicle Dealers.

Federal Tax Lien or Release. Direct appeals to the NJ State Tax Court can only be filed if the assessment exceeds 1000000. GU-11 Renewreplace DL- out of state for extended period pdf.

Please note the tax appeal filing deadline is April 1 2022If your municipality went through a district wide revaluation or reassessment the deadline is May 1 2022. There are several vehicles exempt from sales tax in New Jersey. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt.

Certain types of Tax Records are available to the general public while some Tax Records are only available by making a Freedom of Information Act FOIA request to access public records. Learn about Tax Records including. If approved you could be eligible for a credit limit between 350 and.

Gloucester County Administration Building 2 South Broad Street PO Box 337 Woodbury NJ 08096 Phone. Tax payments can be mailed to. If a business takes out a loan secured by business property or other assets such as equipment a UCC financing statement form is filed.

At common law a person who finds abandoned property may claim it. Tax Accounting. Residents are encouraged to contact the Ocean County Tax Boards office via telephone 732-929-2008 for any assistance.

An appeal must be filed with the Sussex County Board of Taxation the Tax Assessor and Township Clerk. To speed your inquiry on a specific piece of property it is helpful if you refer to the property by its address or docket number which appears in the legal advertisement. Or delivered in person to.

The Tax Court of New Jersey is located at the Richard J Hughes Justice Complex 25 Market Street Trenton NJ. File with a tax pro At an office at home or both well do the work. The sale date information displayed on this Web page is.

For your convenience property tax forms are available online at our Virtual Property Tax Form Center. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. 230 tax_collectoreast-windsornjus Online Tax Payment and Information Tax payments can be made online by e-check or debit card or credit card 24 hours a day seven days a week.

Sale at Auction Sales at public auction are executed by the Sheriffs Office approximately four months after a judgment is docketed. Co-Op 100 additional per page. These records can include Cape May County property tax assessments and assessment challenges appraisals and income taxes.

If you wish to claim exemptions other than the ones listed below contact the MVC Sales Section of the New Jersey Division of Taxation at 609 984-6206. The IRS can see them in dividend and stock sales reportings through Forms 1099-DIV and 1099-B. Keyword Auction ID GO.

Check this calendar frequently for new updates. Notice of the sale is advertised in The News Observer and posted on the bulletin board inside the Salisbury Street entrance of the Wake County Courthouse 20 days prior to the auction date. 70 Fairton-Gouldtown Road Bridgeton NJ 08302 Tax payments can also be made online.

When using this form place your dealer tax stamp in the upper right side of the document near the NJ state seal BA-62 Affidavit of Surviving Spouse pdf. Hall of Records Cochran House Building 83 Spring St Suite 304 Newton NJ 07860 Phone. Please feel free to contact the Sheriffs Sales Office at 609 989-6144 or 989-6102.

Initially a minimum bid of 100 dollars is made by the plaintiff in order to start the bidding process. Tax appeals can be filed annually on a property by the owner on or before April 1st of the tax year. To claim your exemptions you must visit a motor vehicle agency.

The original title will be sent to the lien holder. However if you did not pay sales tax at the time of purchase you will need to pay the sales tax based on the actual amount paid for the vehicle. To do so the finder must take definite steps to show their claim.

El Dorado County CA Tax Defaulted Properties Auction March 31st - 31st. The judgment of the county board of taxation may be appealed to the Tax Court of New Jersey by filing a complaint with the Tax Court Management Office within 45 days from the date of the mailing of the judgment. Abandoned property is defined as personal property left by an owner who intentionally relinquishes all rights to its control.

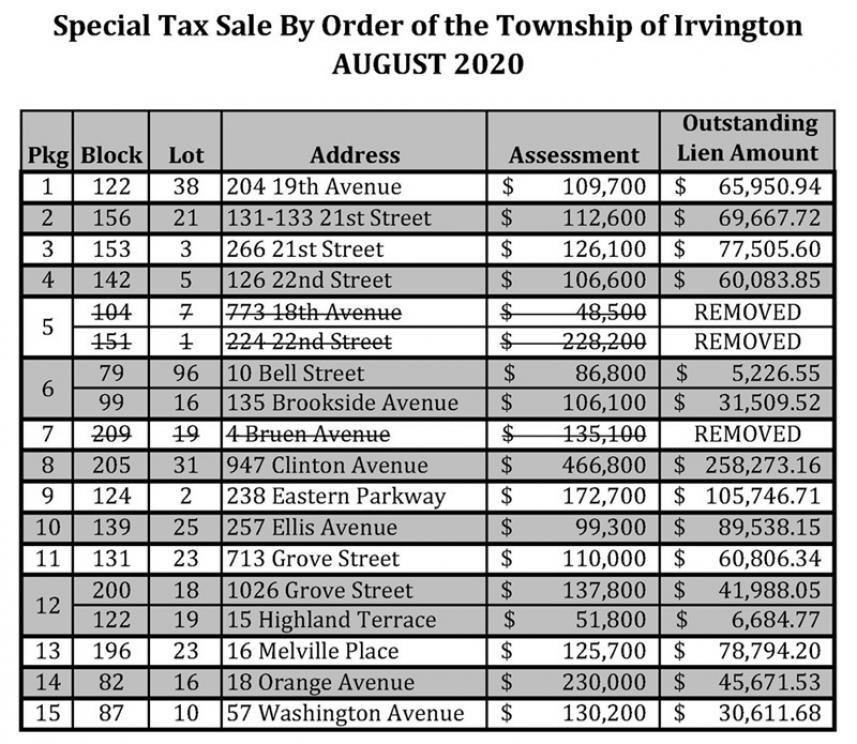

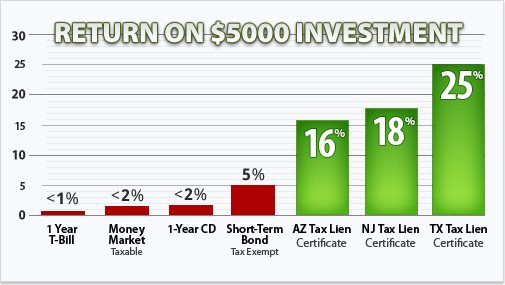

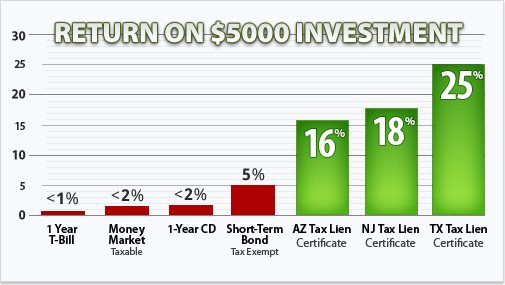

The lien protects the governments interest in all your property including real estate personal property and financial assets. Tax Sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the. By Ann Lien Nov.

Sales of property are open type auction sales no sealed bids. The homeowner has to pay back the lien holder plus interest or face foreclosure. COVID-19 NYC Real Estate.

New York State must file a New York Nonresident Income Tax return Form IT-203 as well as a New Jersey Resident Income Tax Return Form NJ-1040. Check cashing not available in NJ NY RI VT and WY. Trenton NJ 08666-0017.

UCC Financing Statement. In order for the property not to be considered abandoned the tax lien holder must. Instructions as well as tax appeal forms can be found and printed from our website.

The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. PO Box 240 Fairton NJ 08320. Bergen county sheriff.

2 Bergen County Plaza Hackensack NJ 07601 201-336-3500. Puts your balance due on the books assesses your. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes.

Contract of Sales with Mortgage Commitment. For example a finder might claim. EIN formerly Corpcode of the lien holder.

Check cashing fees may also apply. These forms are typically filed with the secretary of state in the state where the business is. Sales are conducted Wednesday at 2 pm.

Sutter County CA Tax Defaulted Properties Auction March 25th - 28th. Sales tax is not collected at the agency for New Jersey dealers. For more information please contact the Assessment.

Adult 13000 check or money order. Property owners who are permanently disabled senior citizens or veterans may qualify for property tax deductions if they meet income and residency requirements. Blake CTC Tax Collector 16 Lanning Boulevard East Windsor NJ 08520 609 443-4000 ext.

As long as the tax lien holder has carried out certain obligations a property is not considered abandoned property for purposes of the various legal remedies included in the Abandoned Properties Rehabilitation Act NJSA.

New Jersey Tax Lien Auction Pre Sale Review Florence Nj Online Sale Youtube

How To Buy Tax Liens In New Jersey With Pictures Wikihow

How To Buy Tax Liens In New Jersey With Pictures Wikihow

How To Buy Tax Liens In New Jersey With Pictures Wikihow

New Jersey Tax Lien Pre Sale Review 50k Lien On 4 000 000 Nj Mansion Youtube

Understanding Nj Tax Lien Foreclosure Westmarq

Tax Sale Lists Now Home Facebook

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

How To Buy Tax Liens In New Jersey With Pictures Wikihow

How To Buy Tax Liens In New Jersey With Pictures Wikihow

New Jersey Tax Liens Explained Florida Tax Lien Tax Deed Research Youtube

New Jersey 2021 Tax Lien Sale Deal Of The Week Youtube

Real Housewives Stars Joe Teresa Giudice Hit With Federal Tax Lien Mansions Teresa Giudice Fancy Houses

How To Buy Tax Liens In New Jersey With Pictures Wikihow

New Jersey Tax Lien Certificates Deal Of The Week Franklin Nj Youtube

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube